DeFi (decentralized finance) and TradFi (traditional finance) have different liquidity architectures. Defi provides services without intermediaries by utilizing cryptocurrencies and smart contracts, while financial institutions operate as transaction guarantors in the current financial world

Compared to conventional industries, DeFi doesn’t possess a self-built capital pool that would grant stable liquidity. As a result, designing a viable and innovative decentralized pool fund model along with comprehensive incentives and interest rate mechanisms that would inject better liquidity has become a primary and well-thought-out objective of DeFi projects

AMM's & Clobs's

Automated Market Makers (AMMs) and Central Limit Order Books (CLOBs). While AMMs use liquidity pools to determine the exchange rate between assets, CLOBs match customer orders on a 'price time priority' basis. In this article, we will compare AMMs with CLOBs on various core debates and discuss possible integrations between the two models. We will also explore the different Automated Market Maker (AMM) models and the impact of introducing concentrated liquidity in an AMM. Overall, AMMs and CLOBs serve other purposes and don’t necessarily need to compete. The best DEX model might require a combination of the two.

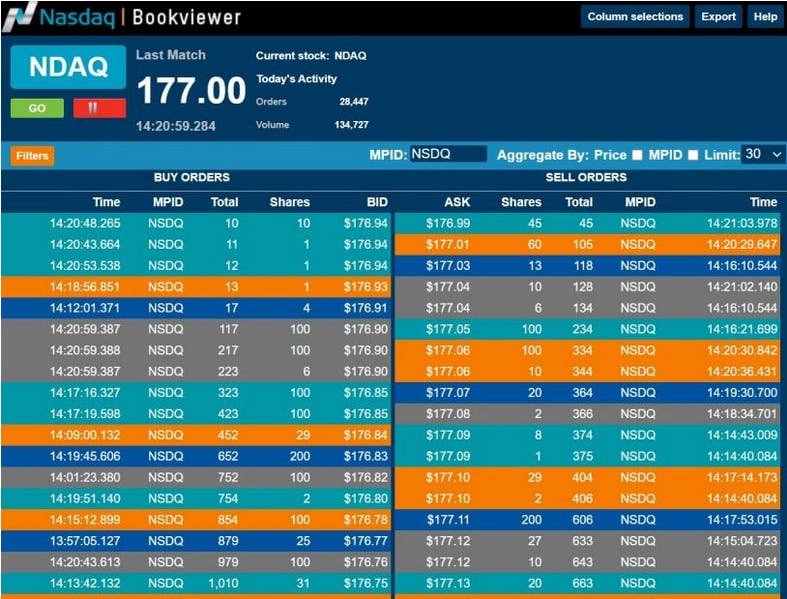

Nasdaq Clob

A central limit order book is an exchange-style execution method common in the equity world that matches all bids and offers according to price and time priority. It allows all users to trade with each other, instead of being intermediated by a dealer. Users can also see bid orders and sizes in real-time.

AMMs are relatively simpler to implement on a blockchain compared to CLOBs, but they generally require more collateral from liquidity providers. CLOBs enable efficient price discovery through a transparent and open bidding process.

AMM's

AMMs use liquidity pools, which are baskets of two or more assets, to determine the exchange rate between those assets.

AMMs are relatively new to traditional finance and DeFi, but they have gained popularity in recent years due to their ease of use and low capital requirements.

AMMs foster a more inclusive environment by eliminating intermediaries and centralized control.

AMMs are relatively simpler to implement on a blockchain compared to CLOBs, primarily due to their lower scalability and latency requirements.

AMMs generally require more collateral from liquidity providers compared to traditional market making.

AMMs are capital-efficient for small trades but may be less efficient for large trades.

CLOB's

CLOBs match customer orders (e.g., bids and offers) on a 'price time priority' basis.

CLOBs enable efficient price discovery through a transparent and open bidding process.

CLOBs offer the order type flexibility and low slippage that traders need.

CLOBs rely on centralized exchanges or platforms, which may lead to a single point of failure and potential manipulation.

Traditional market makers can provide liquidity with less collateral compared to AMMs.

CLOBs are capital-efficient for large trades but may be less efficient for small trades.

Conclusion

To navigate disruption within financial services, DeFi requires liquidity with a robust pricing mechanism, liquidity forecasting, and a contingency funding plan.

DeFi has become a game-changer in the financial services industry by providing a decentralized, transparent, and secure environment that can accelerate adoption and advancements in financial services